Doug McNeilly

Realtor®

No Games, No Refrigerator Magnets, Just Solid Timely Advice. That is what we do at Doug McNeilly Homes.

A Real Estate Agent's old value proposition was that “we” had access to the information. No longer. Buyers and Sellers have instant access to most of the same information as Real Estate Agents. This information is quickly and easily found online. Yet, at the same time too much information can be found online. This is where my value comes into play.

My value as your Buyers or Sellers Agent is my ability to:

- Assist you in making sense of all this information

- Help you understand what options exists

Price is a moment is time – the market is always changing!

What Clients Say Bout Me

Get an Instant Estimate on Your Home

Use the CB Estimate® tool to learn your home's value so you can tackle the real estate market with confidence.

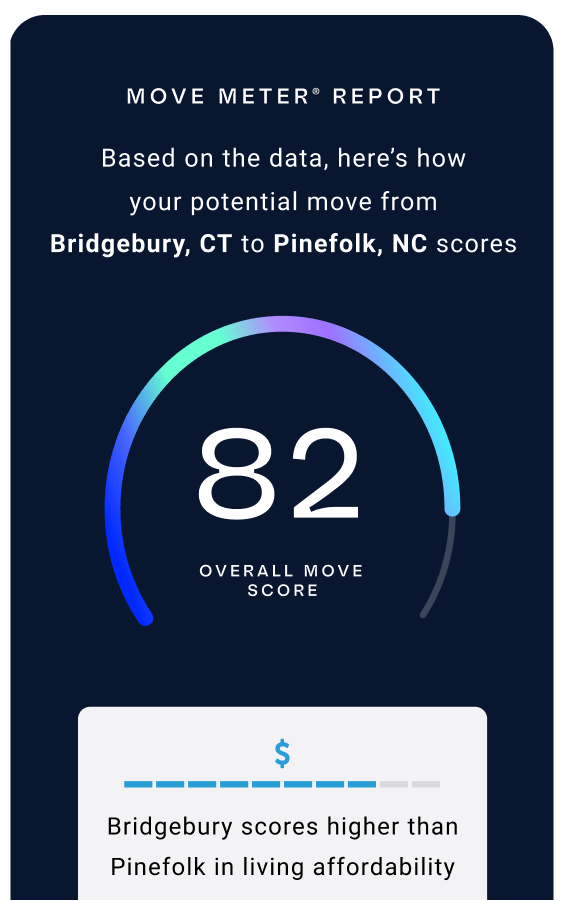

Move Meter

The Move Meter® lets you compare locations based on living affordability, average home prices and other important factors.

Sample Mortgage rates

Contact Me

Phone: 857-233-3295

Email: Doug.McNeilly@NEMoves.com

Top of page